Are you compromising your personal prosperity by not making regular superannuation contributions for yourself?

It’s common for mining and resources business owners to pay everyone else and reinvest profits back into their business before paying themselves a regular wage AND superannuation. It’s important to understand that short changing yourself can have significant consequences for your future prosperity as well as significant CGT implications should you decide to sell your business.

The tendency for business owners and other self-employed Australians to under-fund their superannuation is widely acknowledged. The Association of Superannuation Funds of Australia Limited (ASFA) states that,

“In general, the self-employed have lower superannuation balances than employees … Almost one-quarter (22%) of the self-employed have no superannuation and other self-employed only have superannuation that is related to previously being an employee.”1

Opting to leave monies in your business as profit rather than take superannuation leaves your personal wealth in the business. This means your future livelihood may be threatened should anything untoward happen to the business.

Failing to extract personal wealth from your business can also result in missed opportunities for growing your personal prosperity through retirement savings and the compounding interest that accumulates on your super investments. You’ll also forfeit the considerable tax savings available in superannuation’s tax-effective environment.

Scenario

Ashley is a (fictional) mining and resources business owner. Prior to starting his business at age 40, Ashley received an annual salary of $100,000 and his employer contributed the mandatory employer superannuation guarantee. While Ashley continued to pay himself the same salary, he didn’t pay himself super.

Let’s compare two possible scenarios for Ashley once he became a business owner:

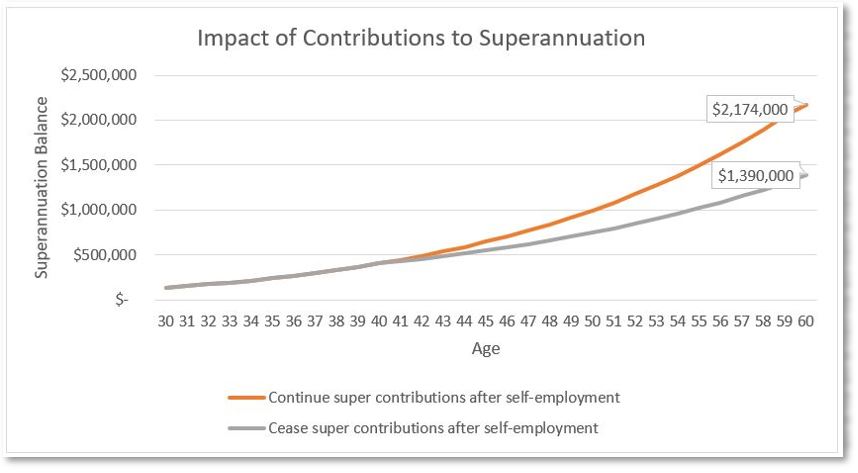

Scenario #1 (the grey line on the chart)

Ashley pays himself an annual salary of $100,000 but does not contribute to super.

Scenario #2 (the orange line on the chart)

Ashley pays himself an annual salary of $100,000 and contributes to super an amount equivalent to the employer super guarantee for an income of $100,000 pa.

Assumptions

- Ashley has an initial super balance of $140,000 at age 30

- Ashley receives super guarantee contributions from their employer

- Ashley’s salary is indexed by 4% pa

- The total net return in superannuation is 7.40% pa

Outcomes

The following chart demonstrates that over 30 years or more, regular contributions to super that benefit from compounding interest can provide a very effective retirement savings strategy for Ashley. The projected difference in account balances for Ashley at age 60 for these two scenarios is $784,000.

Disclaimer: The above projection is for comparison purposes only and is not a guarantee. The projection is not intended to be your sole source of information when making a financial decision. You should consider whether you should seek advice from a licensed financial adviser before making any decision about contributions to superannuation.

Disclaimer: The above projection is for comparison purposes only and is not a guarantee. The projection is not intended to be your sole source of information when making a financial decision. You should consider whether you should seek advice from a licensed financial adviser before making any decision about contributions to superannuation.

For business owners planning to sell their business, there are further considerations:

For business owners under the age of 552 at the time of the sale of their business, superannuation can play a significant role in CGT savings. A CGT concession for small businesses provides a retirement exemption lifetime limit of $500,000 when the exempt amount is paid into a complying super fund or a retirement savings account. This in itself can have a significant influence on your future personal wealth.

Your decisions around super are all the more important since 1 July 2017 when the concessional contributions cap was reduced to $25,000 per financial year.

For many individuals and business owners, paying down mortgages and affording school fees have been the priority in the early years of their working lives. Most then relied on contributing large sums into super much later in their working lives when those expenses were paid for.

However, the reduced annual contribution cap means that mining and resources professionals and business owners now need to begin contributing to super earlier, at the same time as they are managing their living expenses. Otherwise, there won’t be sufficient money in their super by the time they retire.

Your next step…

As a business owner in mining and resources, having an appropriate superannuation strategy in place is key to making the most of your earning capacity. Then when the time comes, you’ll be able to enjoy the retirement lifestyle of your choice. Importantly, if you are thinking about selling or making changes to your business in preparation for your retirement, I urge you to seek financial advice before you start the process so that you may take advantage of available super and ATO concessions.

If you’d like to enjoy greater personal prosperity, your next step is to find out how you can extract wealth from your business and invest it in superannuation to make the most of tax saving benefits and wealth accumulation opportunities. As you’ve read here, the reduced super cap means you’ll need to manage your income so that you can plan for retirement, afford your day-to-day expenses and put any surplus cash to good use.

I’d be very pleased to help you and invite you to contact me on +61 7 3007 2000 or email contact@resourcesunearthed.com.au

1 https://www.superannuation.asn.au/ArticleDocuments/359/Super-and-the-Self-Employed-May2016.pdf.aspx

2 https://www.ato.gov.au/General/Capital-gains-tax/Small-business-CGT-concessions/

Resources Unearthed is a solutions hub that provides integrated financial, legal and business advisory services for executives, professionals and business owners in the mining and resources sectors.

Stratus Financial Group and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This is general advice only and does not take into account your objectives, financial situation or needs, so you should consider whether the advice is relevant to your personal circumstances. You should also read the relevant Product Disclosure Statements (PDS) before making any financial decisions.